Greetings, this welcome Spring Equinox week!

March’s season welcome so far is the fine-even-even-when-frustrating madness that is annual college tournament basketball.

But headlines local, national and global in scope probe deepening developments with historic echoes, even an eerie anniversary, of drearier days.

Current news, political, banking industry and financial markets strive to respond in the aftermath of last week’s collapse of California-based Silicon Valley Bank, with some others falling as well.

There’s a decidedly psychological cast to the language applied in making sense of the crisis.

Such common terms as confidence, depression, even the now-politically polarized woke vs conscious/awake/aware are useful and significant in both clinical mental-health and depth/soul psychological dimensions. If considered at all, they’re usually associated with the individual level and personal relationships.

Yet as Jung pointed out with one of his core ideas, psychologically all of our individual human experience — and our response to it — is also collective. We express this consciously through our relationships, groups, culture, institutions, nations, etc. Unconsciously it shows up in how we experience and respond to something that’s both individual/personal — like birth, death, marriage, falling in love — and universal to all human experience. Jung called this the archetypes or archetypal level of the collective unconscious.

So, today’s banking crisis topic is a natural for newShrink’s focus through lenses of journalism, history and psychology.

Some themes and context

The title idea of bankable confidence is taken loosely from such slang expressions as “you can take that to the bank” or “bank on it” to indicate trustworthiness. (A quick search suggests these came from 50s celebrities or from obscure 70s TV characters. Earlier origins, perhaps during the years-long 20s-30s Great Depression, seem more likely.)

In full disclosure, my take on several stories and elements of today’s topics is informed by personal experience from more than a decade and a half working in corporate communications and investor relations for what became a megabank, predecesor to today’s Wells Fargo. My couple of conclusions about today’s stories based on this require some context:

From late 80s through early 2000s, it was during the era of breathtakingly fast bank growth and consolidation through acquisitions (at First Union I was with an acquirer-bank of the time). It was growth at times fueled by sweeping deregulation, removal of bans on interstate banking across state lines, for example. At other times regulatory restrictions and requirements curbed risky excess. Some even catalyzed progressive-yet-profitable business responses to underserved customer bases, communities and workforce development. Notable examples were the company’s robust, data-, employee- and market-driven efforts around diversity, inclusion, and work-life balance — all of today’s distracting woke stuff. In the 90s…

This work was close-up communications and integration of corporate cultures in more than 60 mergers along the east coast. They ranged from stellar, “win-win” deals with complementary partners to gigantic “failed-bank” scenarios that devastated late-stage-careers, communities, employee pensions and 401(k)s. And there was more than one downright hold-your-nose stinky deal in every imaginable way.

I was just lucky, and am grateful, that my early-retirement, with the ‘02 acquisition of both the bank and its name Wachovia, and my ensuing depth psychology grad school and practice, were under way long before 2008. In that nation- and industry-wide financial meltdown, many friends and former colleagues lost big portions of retirement-nesteggs and 401(k) value with then Wachovia’s near-collapse and acquisition by Wells Fargo.

This is only a mostly unscathed glimpse of potential human-scale impacts in news-months like this one. A couple of my general conclusions based on those years:

🌀An equilibrium, ebb and flow or dynamic tension of creative-expansive growth vs regulatory and other risk-management protections seems an essential defining feature of a healthy banking company, more vital the larger the bank. To me a version of this is true for any thriving business, and for democratic institutions like courts, law and government as well. All of these settings are examples of Jung’s essential transcendent holding the tension of the opposites, at the collective organizational level.

🌀Regardless of your political leanings or profession, you probably don’t want yourself or anyone you care about involved in any role or aspect of a failed-bank situation regardless of rescue remedy — OR with a deregulated free-for-all in any industry (and however much you think you love pure capitalism.)

🌀As for diversity, inclusion, the “woke” stuff: Banks and other successful businesses and workplaces, particularly big ones like Disney with multi-state market appeal, invest significant time, money and human capital in such priorities over a period of time for one reason. They are accurately reading and responding to their market customer, employee and community bases and have determined there’s cost-benefit in the direction of profits and sustained business.

🌀On a final note of irony, First Union’s earliest, largest, most enduring, profitable and complementary partnership acquisitions… its largest, most complex and devastating failed-bank transactions… and impetus for its earliest and vigorous customer, investor and employee-focused diversity, inclusion and equity efforts… were all in Ron DeSantis’ war on wokeness Florida. The latter diversity effort was largely in response to the Florida bank’s large affluent Cuban-American Miami-area market and other large statewide populations.

🔵

Now news…

“the first rough-draft”

Pictured above is last Monday’s line of customers waiting to withdraw deposits from Silicon Valley Bank. One of the current crisis’ new complications is the immediacy of online banking that enables customers to withdraw/transfer their deposits 24/7 on their smartphones or laptops. No longer can a closed branch for a bank holiday slow or prevent a run-on-the-bank.

Other familiar figures here have played prominent roles, or made loudly quotatable quotes, in the weeks’ unfolding banking story. Whatever your take and preferences on the politics here, in left column are two of the perhaps most seriously smart financial-industry-savvy minds in Washington, Senator and longtime Harvard law bankruptcy professor Elizabeth Warren and her long-ago star student, California Congresswoman Katie Porter. At bottom left is former Congressman and finance chair Barney Frank, co-author of the Dodd-Frank bank regulatory safeguards in the wake of the 2008 financial meltdown. (Complicating this week’s story, Frank has most recently been a board member of another of the poor-performer, now-failing banks.)

At right column are Fox Channel’s Tucker Carlson, Florida Governor/presumed Presidential hopeful Ron DeSantis and Senator Josh Hawley. They’re among the week’s loud pontificators — not on potential solutions or strategies, just sound bites blaming “distraction by… wokeness?”

An assortment of stories and some headlines…

U.S. Financial Turmoil: Silicon Valley Bank Collapse and the week’s Aftermath (The New York Times)

Bank Runs, Crypto Concerns and Takeovers: A Timeline of the Panic (The New York Times)

Silicon Valley Bank’s collapse led to the failure of a second bank and prompted regulators to move to contain the fallout in the U.S. banking system.

Embedded stories and video provide excellent summary and context for developments this past week.

After Silicon Valley Bank collapse, Washington asks: Is it to blame? (The Washington Post)

Fifteen years after a financial meltdown sent the country into a recession, policymakers had vast power to probe a failing firm — yet missed signs of a crisis.

Silicon Valley Bank collapse puts new spotlight on a 2018 bank deregulation law (NBC News)

Democratic Sen. Elizabeth Warren, who led the push against the Trump-era law, now wants to restore the rules on financial institutions. Biden is also calling on Congress to act.

OPINION/Elizabeth Warren Guest Essay: Silicon Valley Bank Is Gone. We Know Who Is Responsible. (NYT)

CA Congresswoman Katie Porter and MA Senator Elizabeth Warren — her former Harvard law bankruptcy professor and mentor — are taking the first step in repealing the Trump-era banking law they blamed for Silicon Valley Bank's collapse. (Business Insider MSN)

Here is an interesting twist between two Massachusetts Democrats on the issues.

Barney Frank, a co-author of key banking legislation, was on the board of one of the failed banks.( NYT)

Barney Frank blames crypto panic for his bank’s collapse. Elizabeth Warren blames Trump. (Politico)

The rift between Frank and Warren is just a preview of what’s to come as Democrats sort out positions on how to respond to the latest banking crisis.

Now we come to the real ? culprit: distraction by corporate wokeness, as demonstrated by any mention of words like inclusion or equity.

OPINION/Who Killed Silicon Valley Bank? (The Wall Street Journal, Andy Kesler)

Apparently no one at the firm perceived any risk from the Fed raising interest rates.

Was there regulatory failure? Perhaps. SVB was regulated like a bank but looked more like a money-market fund. Then there’s this: In its proxy statement, SVB notes that besides 91% of their board being independent and 45% women, they also have “1 Black,” “1 LGBTQ+” and “2 Veterans.” I’m not saying 12 white men would have avoided this mess, but the company may have been distracted by diversity demands.

🌀For context, even in the early 90s there weren’t many high-profile, successful corporate boards in any industry who weren’t responding to legitimate pressure to increase women and people of color in board- and c-suite roles. LGBTQ focus was still evolving, though there was visible, vocal emphasis for some corporations. At that time many corporate board members, as well as senior executives, were white male military veterans. Today’s increased veteran focus seems likely related to the aftermath of years-long deployments in Iraq and Afghanistan as well as the more gender- and racially diverse military. Why would success-focused businesses not want boards and leadership responsive to and reflecting of their target markets?

Conservatives blame Silicon Valley Bank collapse on 'diversity' and 'woke' issues (NBC News)

The GOP was traditionally aligned with business, but an ascendant populist wing is more concerned with punishing businesses that espouse disfavored ideas.

Was Silicon Valley Bank too 'woke'? Why Republicans blame collapse on 'diversity demands' (USA Today)

And in counterpoint this, from the above comprehensive NYT coverage.

Fact Check/ No, ‘Wokeness’ Did Not Cause Silicon Valley Bank’s Collapse (NYT)

Blaming workplace diversity or environmentally and socially conscious investments for the firm’s downfall signals a “complete lack of understanding of how banks work,” one expert said.

And across global markets as the week continued…

What to know about the Credit Suisse crisis and its global impact (WAPO)

Credit Suisse was granted a liquidity lifeline from the Swiss National Bank but fears of a market contagion remain in the wake of Silicon Valley Bank’s collapse.

🔵

Meanwhile, amid all of this last Monday I happened to catch, as I seldom do, Rachel Maddow’s now-weekly show. She turned the focus back 90 years — to a story and character less familiar than I had thought, and that eerily apt anniversary mentioned above.

History’s quirky twists of timing

The program (partially linked below and browsable further on You Tube) begins with the November 8, 1932 landslide election of Franklin D. Roosevelt at the worst depths of the then four-years-long Great Depression. Banks were failing, desperate depositors “running” to withdraw their money increased the mass panic, which in turn led to more bank failures and panic. Making matters worse, FDR was the last elected president whose inauguration by law had to wait until March 4. (Congress acted to move the inaugural to today’s earlier January date because of that crisis.)

Pictured below are FDR’s election headline in The New York Times and scenes from his March 4, 1933 inauguration. Then pictured are immediate actions he took within just a few days to stem the crisis. This began the long reversal and recovery from the economic Depression that would continue through most of the 30s until World War II.

Among these, on March 6 to stem the rush of panicked depositors he called a first impromptu bank holiday. He called on Congress to create the Federal Deposit Insurance Corporation (FDIC), pictured at center. The bill was passed and signed by June.

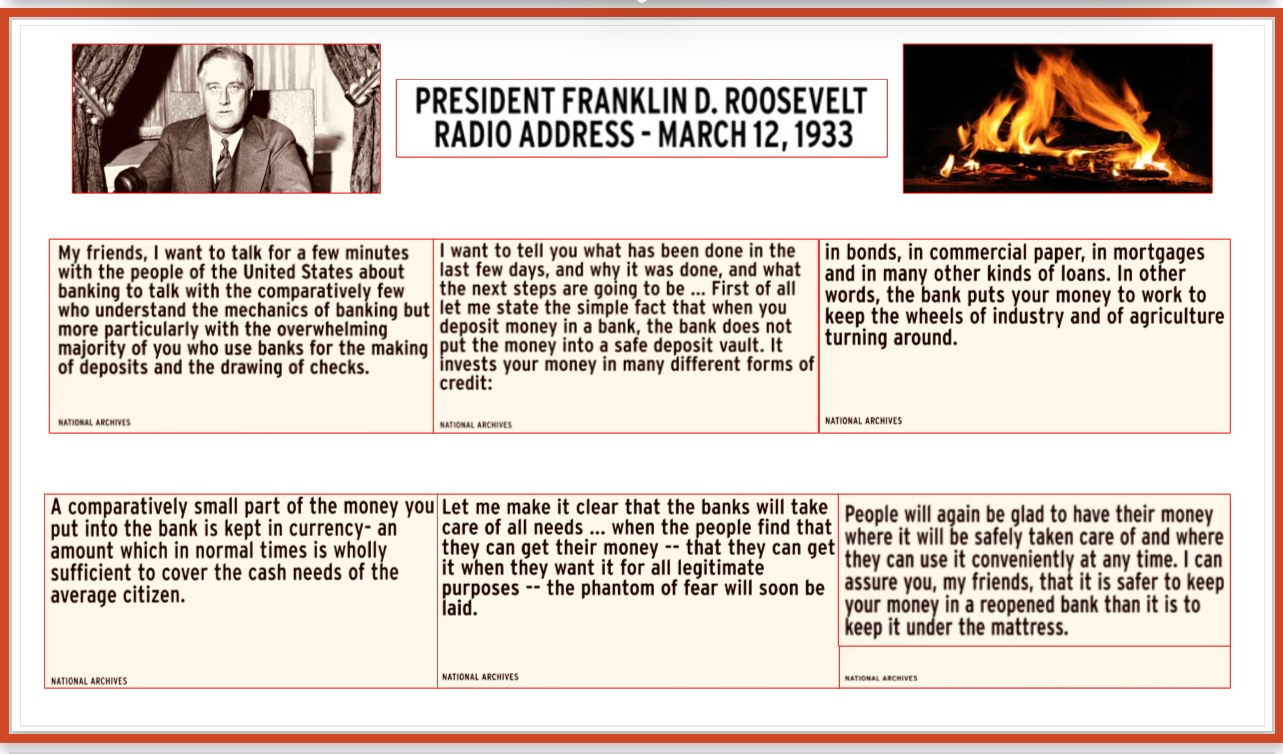

Pictured at bottom right is FDR’s other action step of that time, the March 12, 1933 first of what would be 31 Fireside Chat radio addresses he would do with the American people. These clearly affected Americans so profoundly that a lot of us not alive at the time assume they must have been something he did weekly. The 31 he presented were over his unprecedented (and not to be repeated) 12-year presidency that even included election to a 4th term because of the dire need for continuity with the nation at World War II. When FDR took to the air-waves it clearly was to inform, educate and calm American on grave matters of life-and-death magnitude. Fireside Chats clearly weren’t the 30s’ and 40s’ version.

Last Sunday was that 90-year-anniversary so eerily apt, amid a current crisis far less daunting and with more viable solutions — thanks in part to many of his actions and programs.

I’ve found the story and address excerpted below riveting, not only for what and how FDR (and Congress) took action, but also what he actually says here.

I try to imagine Americans today sitting still long enough to listen and absorb such vitally important stuff, explained with such elegant simplicity.

I wonder, also, how many of us today, even well-educated and working in business or finance, actually know or fully get some basics here. (For an example that sounds backwards, unlike in our other personal or business accounting, deposits are liabilities owed and loans are income-earning assets.)

One more general note about FDR and the Depression, especially in the South: I’d like to hear from any of you with family stories and known history you’re willing to share about them and that period.

I’m especially interested in the great many middle-to-upper-middle class, mostly white male Americans who came of age during World War I then launched adult lives, businesses and families in the prosperous postwar Jazz Age Roaring 20s.

It seems to me that, whatever their political, racial (or racist/white supremacist) and socioeconomic-status proclivities might have been before the 1928 Depression began, for a fair number the losses, adaptations of work, relationships and community for survival, raising a family, protecting those under their care, made them forever-after FDR Democrats. This was the case with my maternal, possibly also my paternal grandfather who was a generation older.

Such progressive milestones as President Harry Truman’s 1948 order desegregating the U.S. military and the 1964 Civil Rights Act under Texas-native President LBJ were pivotal, important and long overdue. But without the FDR legacy and a healthy showing by those carrying it forward at the polls and elsewhere, it is hard to imagine these happening even when they did.

On the Fireside Chats, for those interested, the You Tube link pictured below is the actual first broadcast, along with great photos from the period. It’s from the Miller Center of Public Affairs at the University of Virginia.

Hearing it in FDR’s actual voice is powerful. It may be great for comparison, if you’re among millions who opt for hearing vs reading a lot of today’s varied material in podcasts and audio books.

And here’s a link that should still connect you to the full Rachel Maddow Show described here. on @nbc

https://nbc.app.link/kcpcluLZdyb

If the link has expired it should be browsable on You Tube.

🔵

Now I’ll leave you on a forward-looking bright note:

Spring at last! It arrives Monday afternoon at 5:24 p.m. EDT.

The link here is to an array of interesting Equinox facts from the Almanac. (The pyramid pictured above is from Mayan or related tradition, in which the Equinox supposedly brings what looks like an enormous snake slithering down the pyramid. Through repeat attempts I see no giant slithering snake, though there are stone snake-heads at the base of the steps. Thanks and kudos to you if you can find it — please do show me!)

🔵

And, that is all I have! Talk to you next week.

🦋💙 tish

… it is important that awake people be awake,

or a breaking line may discourage them back to sleep;

the signals we give — yes or no, or maybe —

should be clear: the darkness around us is deep.

— William Stafford, “A Ritual to Read to Each Other”

🔵